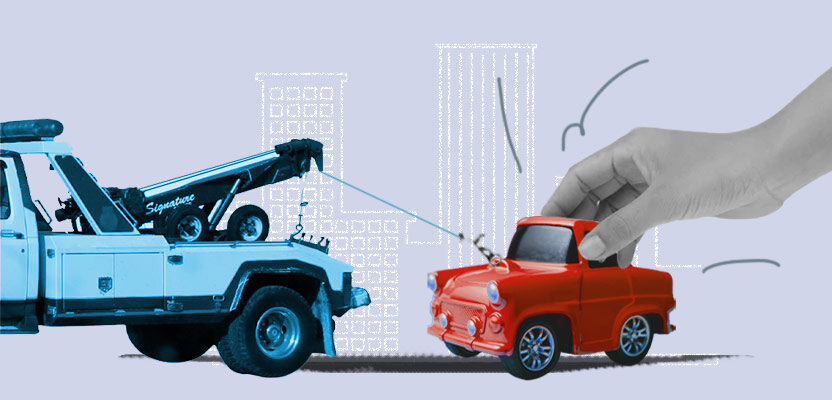

Unbelievable Info About How To Fight Repossession

This book teaches you what you need to do and to know upon.

How to fight repossession. If you can't afford the payments, donotpay can help you ask for a payment plan or. A creditor can start the repossession process almost immediately if the account goes into delinquency. Seek legal help contact a consumer rights lawyer to discuss your rights.

You can use solosuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt. If you are not sure you can make your next payment, contact your lender as soon as. Get some free representation and advice about the threatened repossession.

There are plenty of organisations that can represent you for free. If you're facing a repossession, you still have legal rights (23 pages) when a credit account is overdue, the lender has the right to repossess the borrowed property. Avoiding repossession your lender cannot take your car if you have made all your payments on time.

An attorney may be able to advise on the. At that point, a creditor contracts with a third. Lastly, repossession companies cannot enter your home unless you grant them permission.

In the case the repo was valid, you will have to pay off any balance you owe to reclaim your vehicle. How to fight repossession for mortgage arrears if you have received a letter from your mortgage lender, advising you that you are in arrears and are threatened with legal action, don’t be. How can debtors fight repossession?

How do i fight a repossession lawsuit? The best way to fight repossession is to start talking to your lender before they take your vehicle. You may be able to negotiate a settlement or payment plan with the lender.