Inspirating Tips About How To Apply For A State Tax Id Number

Businesses must use my alabama taxes (mat) to apply online for a tax account number for the following tax types.

How to apply for a state tax id number. Adoptions is used to apply for an atin. Sales and use tax any individual or entity meeting the definition of dealer. Loginask is here to help you access applying for a federal tax id number.

Registration requires your business owner name, telephone number, mailing and physical. Click to find out if you need the permit (s). How to apply for a state tax id?

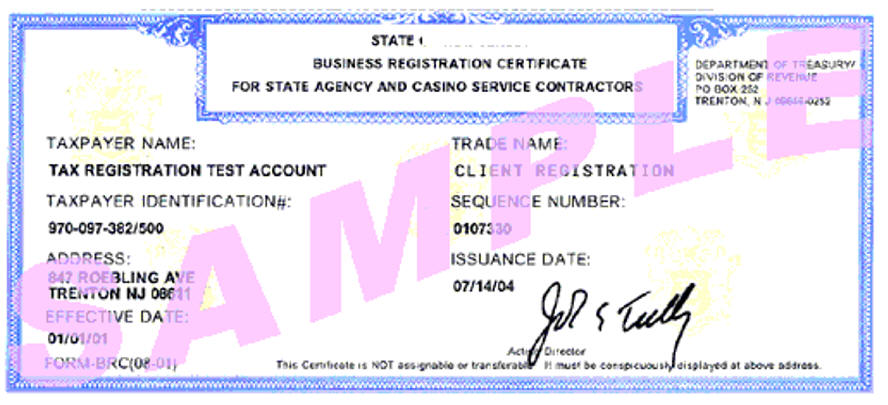

Your brc will include a control number used only to verify that. You can apply for this tax id number online with the irs. This license will furnish your business with a unique sales tax number (utah.

(eastern time) monday through friday to obtain their ein. At least get a tax id and file a dba and in most cases obtain a tax id number. Applying for a federal tax id number will sometimes glitch and take you a long time to try different solutions.

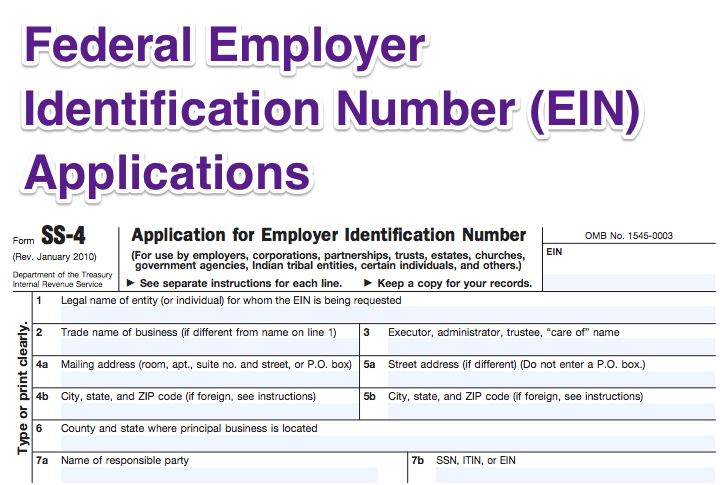

Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business. The person making the call must be. Check with your state government’s department of revenue website for more information on how to obtain a state tax id number.

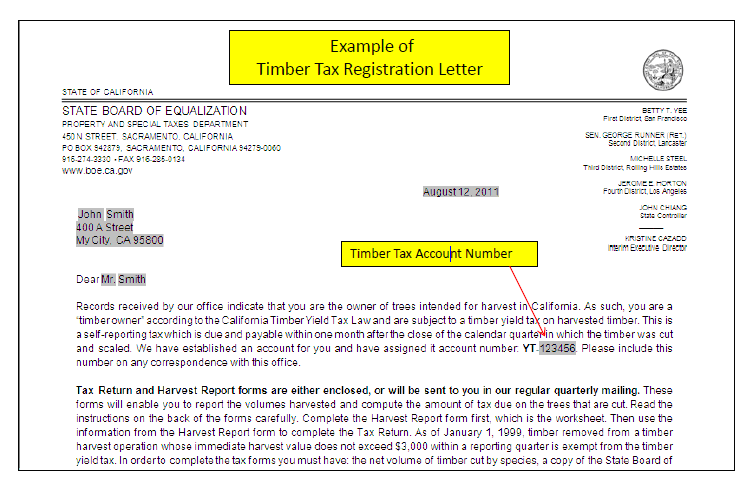

All businesses need an alabama tax id, all retailers and. After your online submission, you should receive your specific tax account number within 15 minutes by email. Fill out the registration form online, or download it, complete it and mail it to the agency.