Real Tips About How To Achieve Good Credit

Ad responsible card use may help you build up fair or average credit.

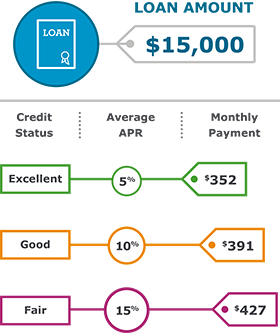

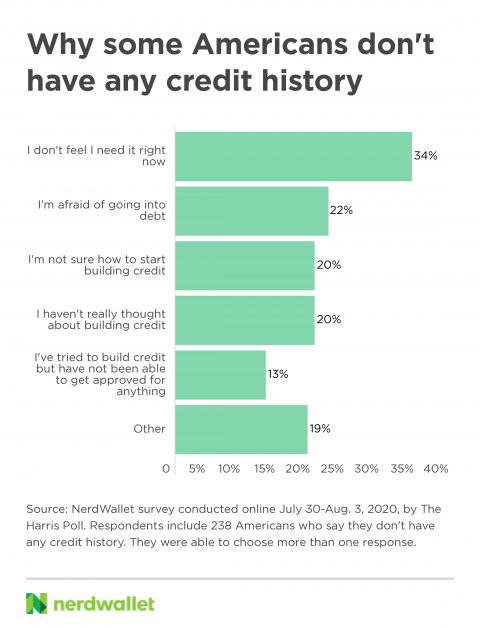

How to achieve good credit. Cards you can get with a social security number. Did you know one in eight americans doesn’t know their credit score? For starters, getting a credit card, paying your bills on time and in full and keeping your credit utilization ratio low are some.

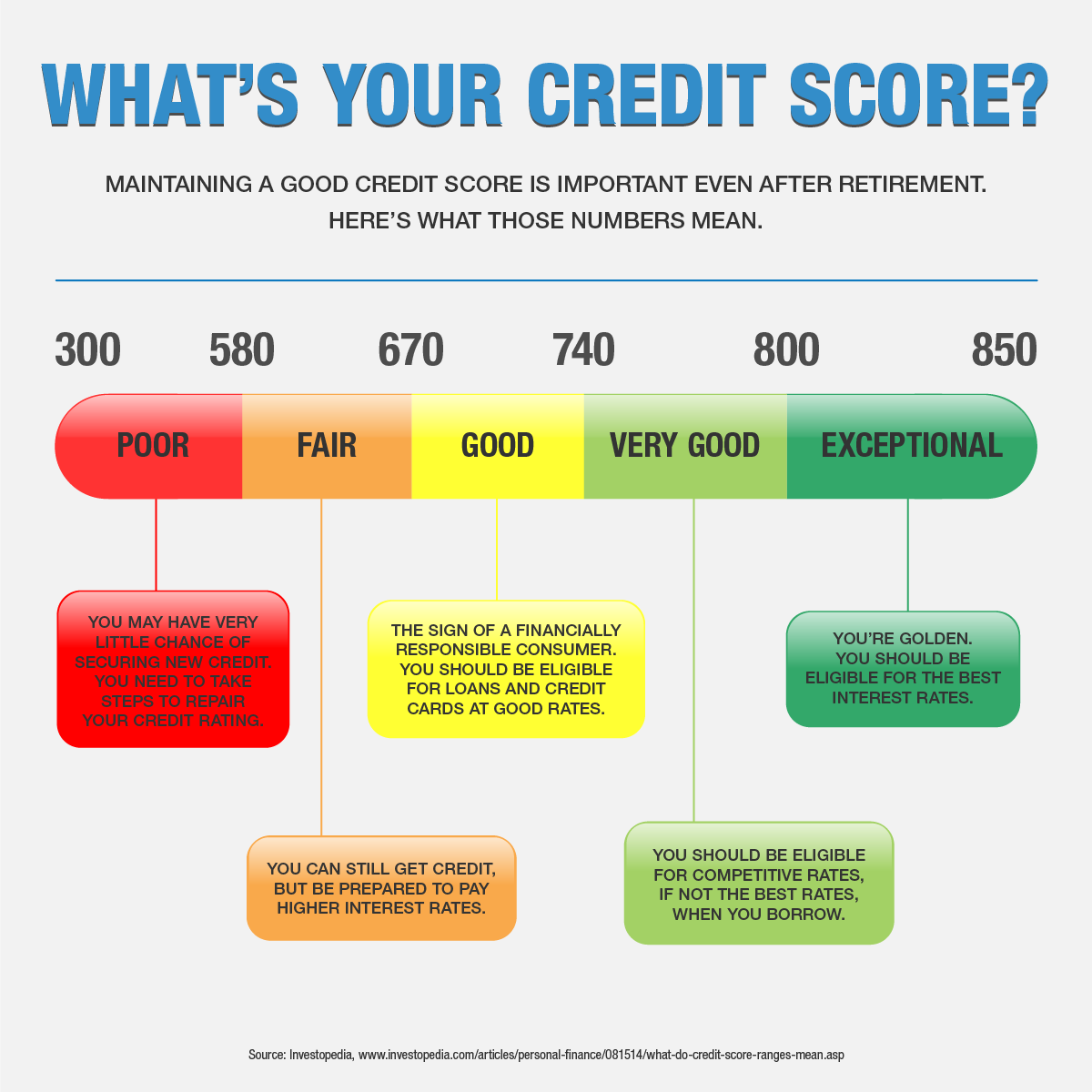

The score indicates a person’s. Credit scores between 630 and 689 is considered a fair credit score; Consider setting up alerts for.

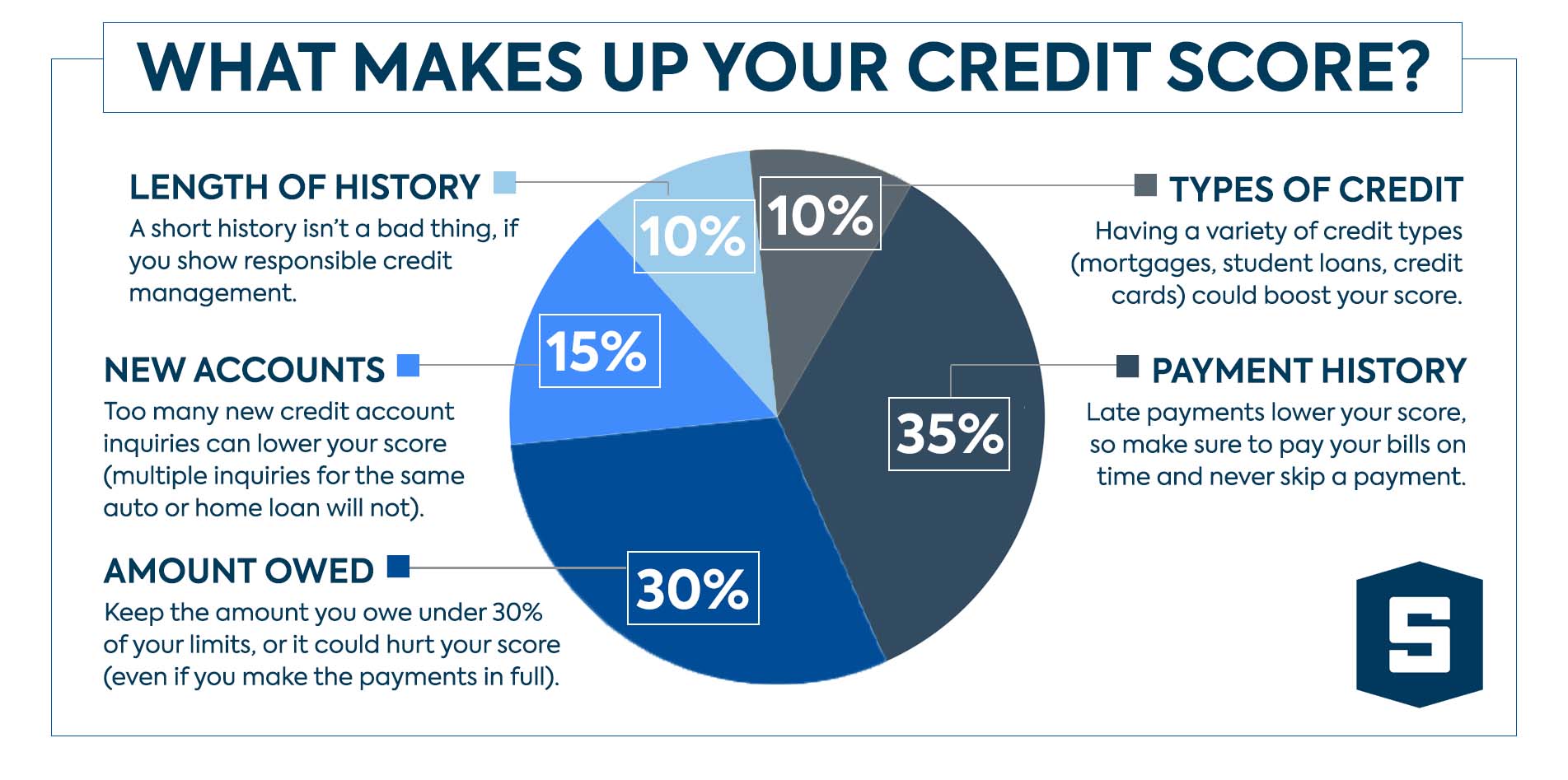

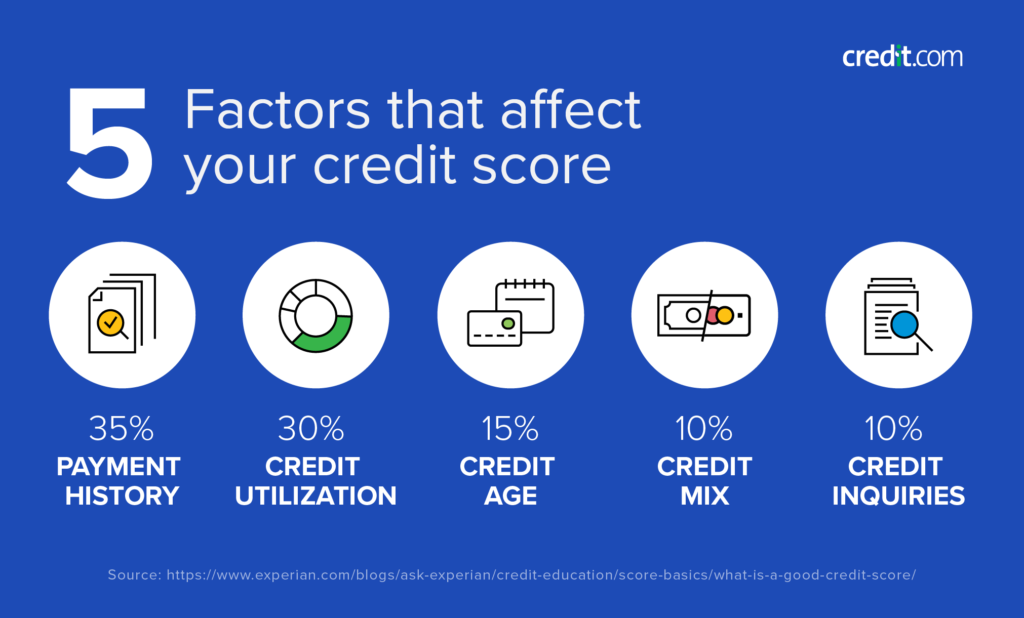

Making timely payments on all your credit accounts, no matter if it’s installment or revolving, is important if you want to be rewarded for having a mix of both. Analyse your credit report periodically and if you spot any issue get it fixed instantaneously. You want to make sure your balance is low when the card issuer reports it to the credit bureaus.

Get expert help with your credit score. Experts advise keeping your use of credit at no more than 30 percent of your total credit limit. Understand what is a credit score · learn how credit scores are calculated · pay bills on time and in full · maintain a low utilization.

Apply for a credit card. Your payment history makes up approximately 35% of your fico ® credit score, so making timely payments is an important way to improve your credit score. Ad 2021's best credit repair companies.

There are multiple benefits to this approach, including achieving good credit and pride in knowing that your actions paved the way to reach your financial goal. Some of the best ways to improve your credit score quickly when you have no credit history include becoming an authorized user, opening secured credit cards, or getting a. This habit lets future lenders and creditors know you're a responsible borrower.